CapstonePlus is a plan that helps employers retain and attract employees by prioritizing preventative health and wellness with a comprehensive health management program that you can offer to your employees at no net cost to them and a net savings to your company.

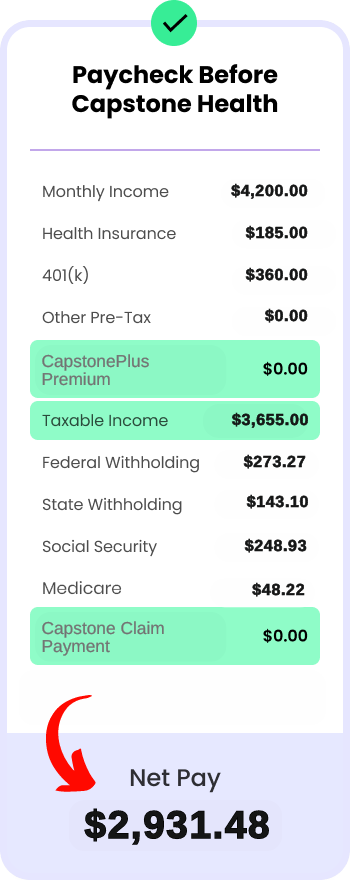

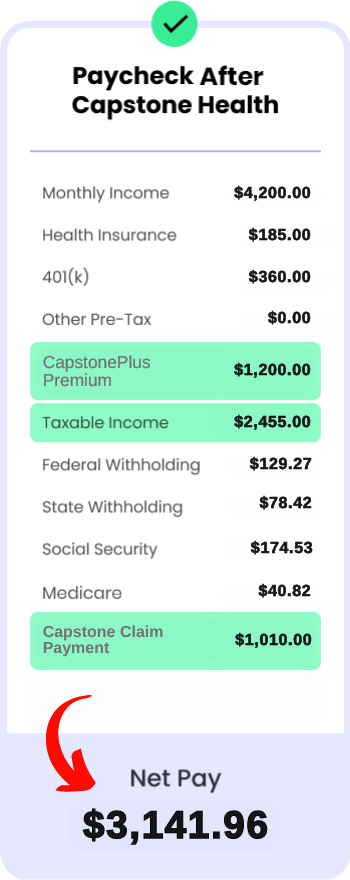

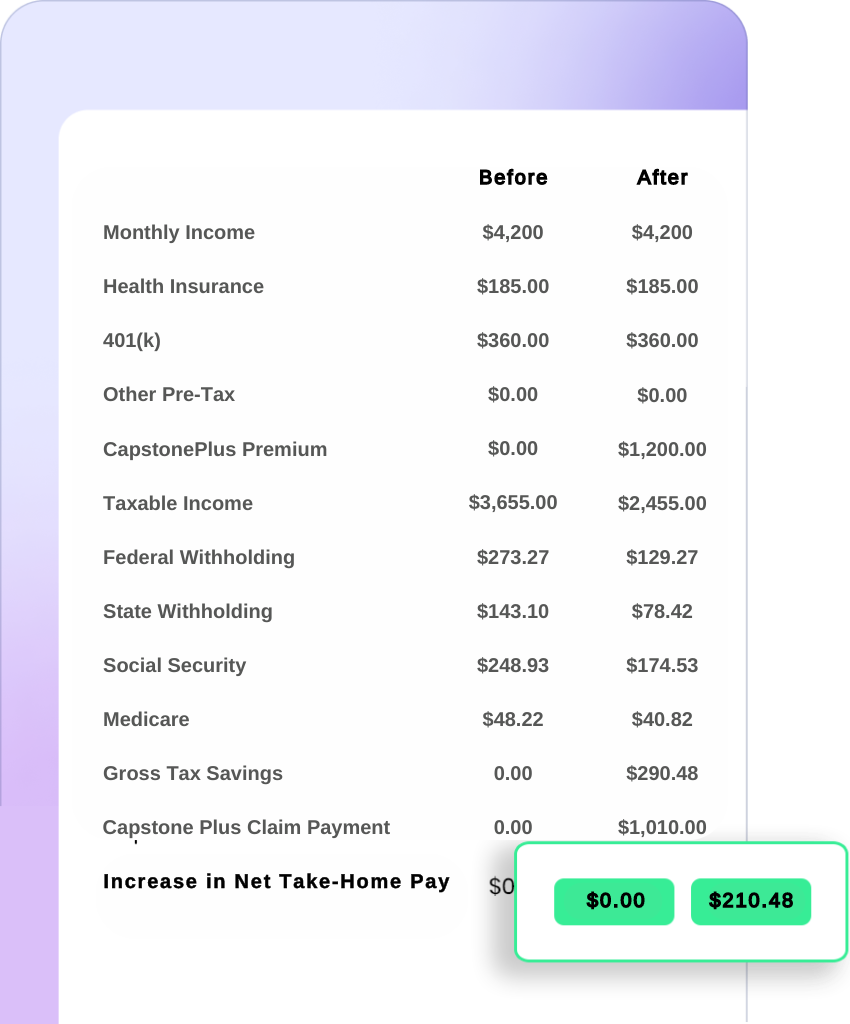

Here are the key numbers this client realized when they implemented our solutions.

Here are the key numbers this client realized when they implemented our solutions.

Here are the key numbers this client realized when they implemented our solutions.

Here are the key numbers this client realized when they implemented our solutions.

Here are the key numbers this client realized when they implemented our solutions.

CapstonePlus is 100% legal and compliant. This is a tax-qualified plan with a wellness focus that uses tax advantaged provisions under the Internal Revenue Service codes “Section 125 Cafeteria Plan and codes 105, 106, and 213(d)” and ACA wellness rules.

Absolutely. Implementing CapstonePlus does not require any changes to your current benefits. If you have a currently medical plan…keep it, and CapstonePlus will ‘bolt-on’ right along side of it. If you do not currently offer medical, than CapstonePlus will provide an outstanding set of benefits for your employees.

Absolutely. In fact, in addition to the tax savings, CapstonePlus can help reduce your expenses by:

This is achieved by employees being active and participating in our health management program through various programs including monthly wellness emails, health coaching and more.

The mechanics of the CapstonePlus premium, and the claim payment are are handled in your payroll system. This allows for both aspects to occur within the same payroll cycle.

Yes! The most recent tri-agency ruling form the IRS, Employee Benefits Security Administration and the Health and Human Services Department ruled that funds could be used for non-medical expenses including rent and mortgage.

Based on the most recent tri-agency ruling dated April, 2024 the IRS, Employee Benefits Security Administration and the Health and Human Services Department ruled that funds could be used for non-medical expenses including rent and mortgage.

Wellness plans have been around since the passing of the Affordable Care Act, which opened the door to structure these plans in their current format.

JOSH SMITH

Licensed Life & Health Agent

NPN: 7300237

Interested in learning how the Capstone Health Plan can be implemented into your company? Book a call with one our team members and we can walk through any of your questions, see if your elgible and draft a savings template.